- #Chase international wire transfer for free#

- #Chase international wire transfer how to#

- #Chase international wire transfer code#

#Chase international wire transfer how to#

How to Get Money to Family and Friends in a Crisis MyBankTracker generates revenue through our relationships with our partners and affiliates. Once the money is wired, there is no bank hold for the recipient, meaning the recipient doesn’t have to wait for the money to clear. Fast – Transfers typically happen within one working day in the U.S. For questions or concerns, please contact Chase customer service or let us know about Chase complaints and feedback. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. households with a broad range of products. JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. However, by staying organized and gathering all necessary documents, you will be able to efficiently complete this process. Most people may be intimidated by the idea of sending a wire transfer due to the amount of paperwork that must be completed. This charge is often added on as a markup to currency exchange rates.

#Chase international wire transfer for free#

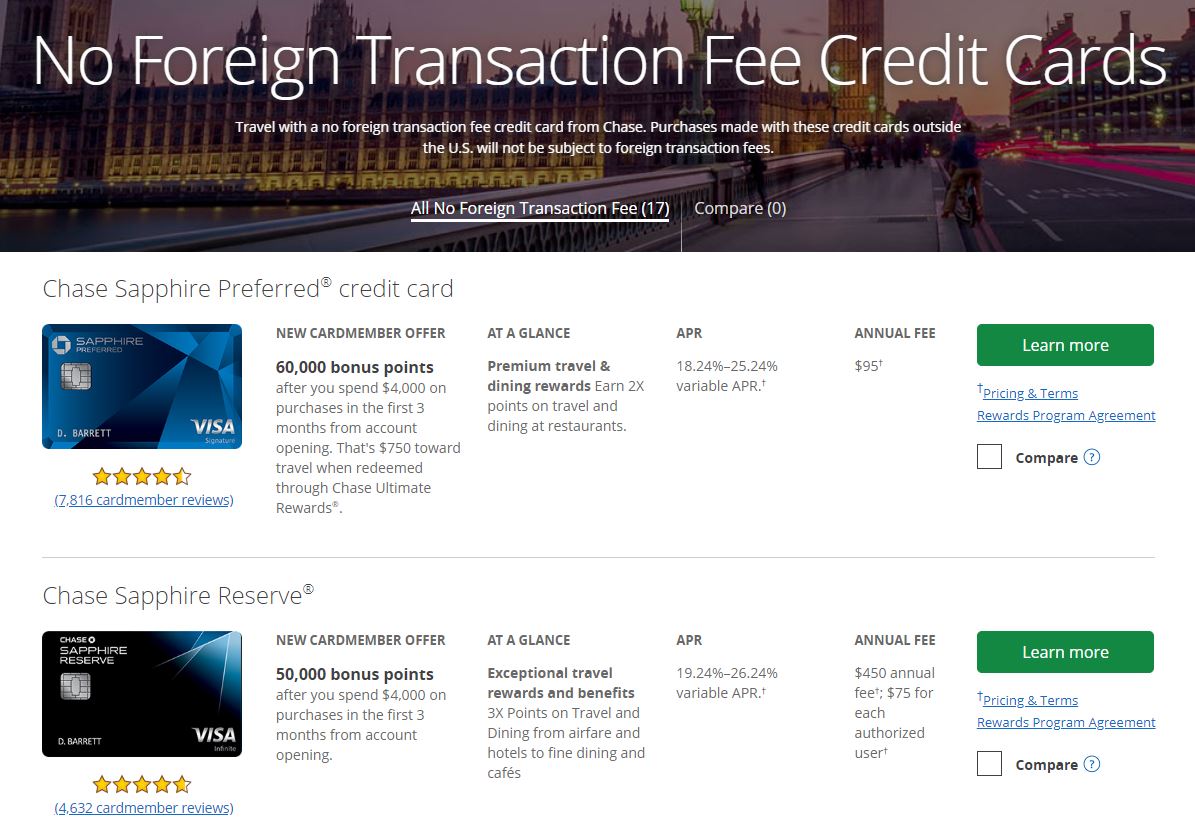

You should also note that some premium Chase accounts allow for free wire transfers. The top mobile payment apps typically offer P2P money transfers where an individual with another person’s email address or phone number can easily send money to their account. For those who frequently send money internationally, there are alternatives to international wire transfers to help keep fees down and speed funds along.

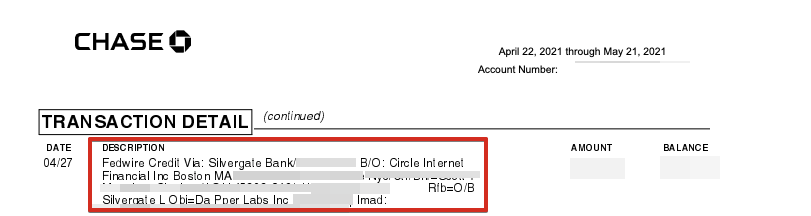

If you need assistance, you and your recipient may need to contact representatives from your respective banks. If you’re sending money internationally, you may need to ask the recipient for a SWIFT code. You’ll also need information about the recipient’s bank, such as its name and address. You’ll then visit your local bank branch, provide the details, and wire the funds. Ask the recipient to confirm the details with their bank or credit union so the money is routed to the right place. You’ll need the recipient’s first and last name, contact information, account number, and routing number for wire transfers. To wire money to a bank account, you’ll need information from the person who will receive the funds. Keep in mind, there are fees attached to receiving an incoming wire transfer. However, the receiving bank may have its own review process which could delay delivery. Chase international wire transfers are typically available to the recipient within 3-5 business days after being sent.

A good example of ACH payments within the US is paying for purchases with a check or book a hotel room without a credit card.

#Chase international wire transfer code#

When sending or receiving domestic and international wire transfers, you’ll use a different Chase routing number for domestic transfers and a SWIFT code for international wire transfers. Chase also charges a $15 fee for incoming transfers to your Chase bank account. You cannot schedule repeating transfers from a Chase personal account. Repeating, regular international wire transfers are only available for Chase business account customers. If you’re a Chasecustomer or are transferring money to a Chase account, refer to the chart below for a list of every Chase routing number.

0 kommentar(er)

0 kommentar(er)